From: Shenzhen Daily | Updated:2022-07-27

Video by Liu Xudong

For Katy Lian, export logistics is becoming increasingly accommodating nowadays.

“Unlike domestic logistics that began to offer users traceability service years ago, international freight transportation didn’t catch up until recently,” said Lian, business and supply chain manager of Samanni, a furniture exporter based in Houjie Township in the city of Dongguan, Guangdong Province. “And it is not just about traceability. The whole process is much smarter.”

Scenes at the furniture factory of Samanni in Houjie Township in the city of Dongguan, Guangdong Province. Photos by Wang Haolan except otherwise stated

Prior to shipping the company’s goods, Lian can plan out the best routes available based on real-time data provided by a cloud-based global trade platform. She can access data collected during transportation, which will in turn help her with her future decisions for the company’s supply chain management. The calculations on carbon emissions generated by different forms of transportation are just a click away.

Katy Lian (R) tracks goods on a cloud-based trade platform with the help of a staffer from Flexport.

A staffer with Samanni packs some of their goods, which will be shipped overseas.

In an age where new technologies such as artificial intelligence, big data and cloud technology are evolving rapidly, the international shipping industry, which remained largely unchanged for decades, is transforming itself, Henry Ko, managing director of Flexport Asia, told Shenzhen Daily.

Henry Ko, managing director of Flexport Asia, has an exclusive interview with Shenzhen Daily.

Flexport is a U.S. Silicon Valley-based freight logistics company founded in 2013. In 2021, the digitally enabled unicorn moved nearly US$19 billion worth of merchandise across 112 countries and regions, with 80% of them coming from China. After branching out in Shenzhen in 2016, it has opened its first warehouse on the Chinese mainland at the Yantian Port area and its largest research and development (R&D) center in Asia in Nanshan District.

A scene at Flexport's warehouse at the Yantian Port area.

“As entrepreneurs, we find rewarding that Shenzhen has attracted different types of talents, including technology talents, [traditional] foreign trade talents as well as cross-border e-commerce talents,” Ko said.

With its strength in research as well as technology use, Flexport is known for its high growth as well as resilience in the face of the pandemic. It has been Silicon Valley’s No. 1 in terms of growth for three consecutive years, public data show. The company’s Shenzhen warehouse saw cargo volume increase by 200% since the warehouse opened in April 2018, according to DP Dang, Flexport Asia’s senior network design manager.

Flexport staffers weigh a batch of goods at the Yantian warehouse.

Firms like Flexport, which promote smart logistics as a solution to logistics woes due to the pandemic, have been growing rapidly in Shenzhen and surrounding areas in the Guangdong-Hong Kong-Macao Greater Bay Area (GBA). Smart logistics features new technologies like big data, artificial intelligence and 5G, which has opened up new growth space for the industry.

A scene at the warehouse of YH Global in Qianhai. Chang Zhipeng

YH Global, headquartered in Qianhai, is another unicorn in the logistics supply chain industry and the first RCEP (Regional Comprehensive Economic Partnership)-approved exporter in Shenzhen. It currently employs over 2,000 people and has pioneered the “integrated supply chain” model taking advantage of technologies such as automation and the cloud.

“We have been investing in technology for a long time,” said Huang Qianqian, director of YH Global’s IT center. “YH Global has immersed itself in contract logistics since its inception over 20 years ago, and has accumulated some core competencies that have given us the edge to swiftly respond to changes during the pandemic and in this VUCA (volatile, uncertain, complex, ambiguous) era.”

YH Global’s recent technological breakthroughs include software, automation and applications of cloud technology, according to Huang, who singled out AGVs (automated guided vehicles) as an example. “AGVs can be thrice as efficient as manual picking,” she said, a factor that she believes will safeguard the company’s business growth in the future.

Despite the pandemic and complex global circumstances, YH Global’s business bucked the trend and has continued to grow. From 2020 to 2021, YH Global’s import and export volume exceeded US$10 billion for two consecutive years, making it the third Shenzhen enterprise after Foxconn and Huawei to pass the US$10 billion threshold in foreign trade. In the first five months this year, YH Global’s revenue increased 32% year on year, with total import and export amounting to US$3.9 billion, up 18% from a year ago.

“What I’ve seen is a transition from quantitative changes [in technology applications] to qualitative changes. I think that’s the main factor behind our uninterrupted growth,” Huang said.

Prof. Wang Guowen. Liu Xudong

Prof. Wang Guowen, director of China Development Institute’s research center for logistics and supply chain, mentioned to Shenzhen Daily an accepted view that the pandemic spurred technological applications in almost every sector.

A bird's-eye view of the Yantian Port area. Lin Jianping

About 93% of logistics firms in Shenzhen have applied new technologies in their daily operations in the past year to save costs and improve efficiency, according to a survey from Shenzhen Logistics and Supply Chain Management Association.

With changing situations, the new generation of supply chain unicorns like Flexport and YH Global are riding the tech wave, while logistics giants like FedEx have also begun to pick up their pace in adopting frontline technologies to upgrade their logistics network.

A lorry is seen outside Flexport's Yantian warehouse.

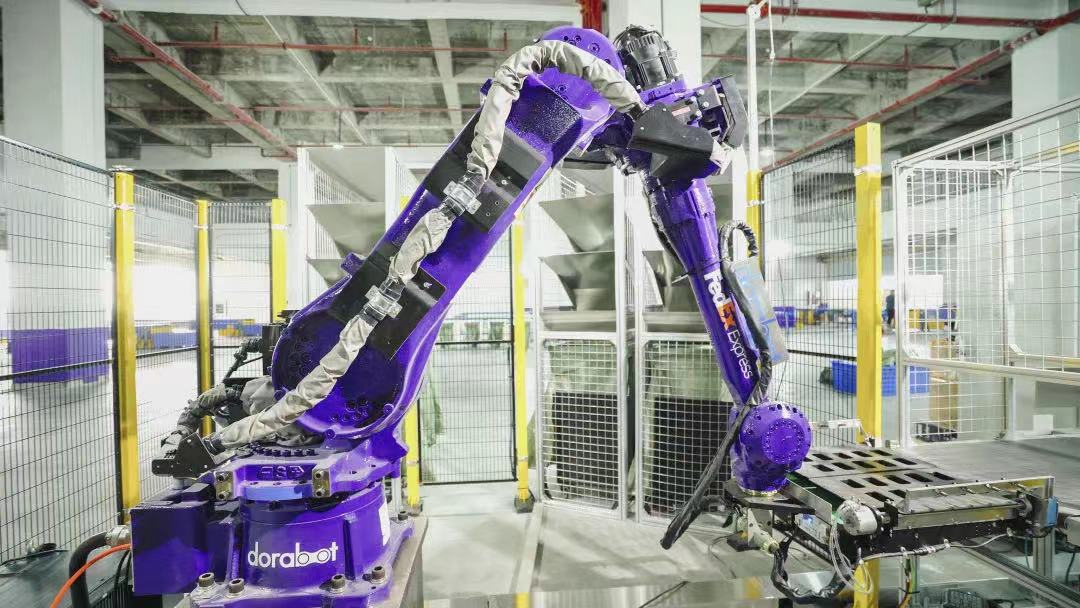

Earlier this year, FedEx put an intelligent sorting robot into use at its South China e-commerce shipment sorting center in Guangzhou. It is especially suitable for handling small import and export parcels from e-commerce traders, the company said.

"This is the first time FedEx has deployed and used an intelligent sorting robot in China," said Robert Chu, vice president of FedEx China. "This represents another endeavor we’ve made to use innovative technologies to promote smart logistics."

A smart sorting robot is put into operation at FedEx's South China e-commerce shipment sorting center in Guangzhou. Photo courtesy of FedEx

As China’s largest export city, Shenzhen has ranked first among Chinese cities in terms of exports for 29 years in a row. With ocean shipping as the main transport mode for global trade, around 90% of the world’s goods are transported by sea. Shenzhen’s ports are also accelerating their digital and smart transformation. On July 1, Yantian Port signed an agreement with Huawei Technologies to speed up its digitalization, while on June 28, Mawan Port marked its first anniversary of being named the first 5G green and low-carbon smart terminal in the GBA. Shenzhen Port handled nearly 13.7 million TEUs (twenty-foot equivalent units) in the first half of the year, up by 6.4% year on year, data from Shenzhen Customs showed July 12.

"When we look at the [ocean] shipping, Shenzhen has the most advanced container terminals in the world," said Prof. Wang. "We have seen several fully automated container terminals, in Mawan and in somewhere else. The container crane can operate on itself by loading and discharging the vessels, and in the container yard, the trailer is also self-driving. The whole terminal is automatic. We also have a data system tracking all the ship movements along the route. In that sense, international shipping is a highly automatic and technology-intensive sector."

A bird's-eye view of Mawan Port in Nanshan. Liu Xudong

Shenzhen’s air shipping is also supported by highly intelligent applications at the airport, Wang said. "There are quite some big data applications in the management of the airport, in the management of the flight loading, route planning and also in the air cargo warehousing system," he said.

Shenzhen’s rising cross-border e-commerce sector is also spurring its logistics sector togo smarter. Customs statistics show Shenzhen’s cross-border e-commerce has increased 35-fold in the last five years, newspapers including Economic Daily and Shanghai Securities News have reported. In April, the Ministry of Commerce ranked Shenzhen among the country’s top 10 pilot zones for cross-border e-commerce.

"We’ve all heard [a catchphrase] that China is a dominant player in cross-border e-commerce globally, while Shenzhen is dominating in this sector nationally," Flexport’s Ko said. Unlike traditional exporters, cross-border e-commerce traders have data and technology in their genes, so they demand more technologically enabled logistics services or smart logistics, according to Ko.

"E-commerce highly relies on efficient logistics, but e-commerce logistics is different from the traditional way of logistics," Wang said, explaining that e-commerce trades are usually fragmented and in small volume, but demand quick delivery. "Consumers will expect overnight delivery, even for international orders," he said.

Wang has previously carried out research on international e-commerce logistics in Shenzhen as well as the surrounding areas in the GBA, and found that, due to the fact of the area being a huge air shipping gateway with domestic as well as global express firms operating their technologically empowered regional hubs here, e-commerce commodities can reach all around the world quickly and efficiently.

A bird's-eye view of the satellite hall of Shenzhen Bao'an International Airport. File photo

Warehousing facilities set up in GBA’s bonded zones, which are used mainly to facilitate import businesses, as well as those established overseas for the sake of efficient international deliveries, are also a factor behind the smooth international flows of goods and resilient supply chains, according to Wang. In Shenzhen alone, eight of such bonded areas have been designated for cross-border e-commerce, while Shenzhen companies had set up over 230 overseas warehouses with a total construction area of more than 2.6 million square meters by the end of last year, official figures show.

"We will continue to work hard, instead of resting our laurels with the current level of technology applications," Flexport’s Ko said. "We hope to continuously expand our R&D team in Shenzhen, to lend support to cross-border e-commerce and the wider foreign trade sector."